Enhancing ESG Performance with the Human Capital Competitive Index (HCCI): A Data-Driven Approach to Sustainable Growth

What is Human Capital Competitive Index (HCCI)?

Human Capital Competitive Index (HCCI) is a survey-based data which informs the user organization as where does it stand on a particular aspect of human capital management with respect to peer basket companies in relevant industry; and most importantly what it can do to enhance productivity to compete in the market.

What is Context for HCCI?

The Human Capital Competitive Index (HCCI) is a strategic framework that aligns with the Securities and Exchange Commission of Pakistan’s (SECP) ESG Guidelines (2023), emphasizing the social (“S”) aspect of ESG metrics. It provides a structured approach for organizations—both listed and non-listed—to measure, evaluate, and enhance their human resource practices in accordance with globally recognized sustainability standards. The SECP guidelines outline 14 key HR metrics, including workforce turnover, diversity and inclusion, compensation equity, employee health and safety, and succession planning, all of which are fundamental to fostering a resilient and ethical corporate culture. By leveraging HCCI, companies can set measurable objectives, conduct competitor benchmarking, and demonstrate a commitment to responsible business practices, thereby fostering stakeholder trust and enhancing longterm sustainability. While HCCI is particularly relevant for publicly listed companies, non-listed entities are also encouraged to adopt these best practices to improve their workforce management and overall ESG performance, ensuring they remain competitive in an increasingly responsible and transparent business environment.

Purpose of HCCI

Assess Organizational Performance

Evaluate current social practices against SECP’s defined metrics to identify areas of strength and improvement.

Drive Strategic Decisions

Provide data-driven insights for improving social impact, workforce engagement, and corporate responsibility.

Enhance Market Competitiveness

Position the organization as a socially responsible entity, attracting investors, customers, and top talent.

Ensure Regulatory Compliance

Align with SECP’s ESG guidelines to mitigate risks and maintain compliance with evolving regulations.

Benefits of HCCI

Enhanced Organizational Growth

- Adoption of these metrics positions organizations as socially responsible leaders, attracting sustainable investments and expanding market opportunities.

- Companies that demonstrate their commitment to ESG principles are more likely to secure funding from ESG-focused investors and financial institutions, fostering long-term financial stability and growth.

Employee Welfare and Retention

- Improved workplace policies and equitable practices boost employee satisfaction, engagement, and loyalty.

- A satisfied workforce contributes to lower turnover rates, reducing recruitment costs and ensuring continuity in operations. Enhanced employee morale also leads to higher productivity and innovation.

Competitive Advantage

- Compliance with ESG standards differentiates organizations from competitors, making them more appealing to investors and customers.

Companies that integrate these metrics into their operations are better positioned to respond to market demands for sustainability, thereby gaining a significant edge in attracting environmentally and socially conscious consumers.

Risk Mitigation

Compliance with ESG standards differentiates organizations from competitors, making them more appealing to investors and customers.

Companies that integrate these metrics into their operations are better positioned to respond to market demands for sustainability, thereby gaining a significant edge in attracting environmentally and socially conscious consumers.

Long-Term Sustainability

Integration of these metrics ensures alignment with global standards, fostering resilience and adaptability in a dynamic business environment.

By adopting these practices, companies can anticipate and adapt to regulatory changes, technological advancements, and societal expectations, ensuring their relevance and success in the long term.

Improved Stakeholder Relationships

Transparent ESG reporting builds trust and credibility with stakeholders, including employees, customers, investors, and regulatory bodies.

Demonstrating a commitment to ethical practices and social responsibility enhances the company’s image, strengthening stakeholder loyalty and advocacy

What is Strategic Importance of HCCI?

HCCI is not just the regulatory perspective but also numbers are the universal language of business. Organizational leaders prefer to take decisions on evidence-based data. Shareholders, board members, CEOs, CFOs all measure results. They are keen to see verifiable connections between human capital investments and leading indicators of organizational sustainability. Human capital analytics and benchmarks have thus become a differentiator between top class and traditional HR department. In the dynamic and competitive business landscape, adherence to the Securities and Exchange Commission of Pakistan (SECP) ESG Guidelines is not merely a regulatory requirement but a strategic imperative. By integrating these metrics into their operational and reporting frameworks, organizations can unlock a multitude of benefits, including enhanced transparency, improved employee satisfaction, and increased investor confidence. This proposal provides a detailed roadmap for organizations to implement these metrics effectively, achieve industry benchmarks, and capitalize on the competitive advantages of ESG compliance

SECP 14 “S” ESG Metrics

- Report the ratio of median male compensation to median female compensation. This transparency promotes pay equity and enhances organizational reputation.

- Measure the CEO’s total compensation against the median Full-Time Equivalent (FTE) compensation.

- Full-Time Employees

- Part-Time

- EmployeesContractors/Consultants

- Percentage of total headcount held by men and women.

- Percentage of entry- and mid-level positions held by men and women.

- Percentage of senior- and executive-level positions held by men and women.

- Percentage of total enterprise headcount held by part-time employees.

- Percentage of total enterprise headcount held by contractors/consultants.

- Grievance mechanism is in place to address incidents of harassment and violence.

- Track the percentage of women and men promoted annually.

- Adherence to global health and safety policies.

- Injury rates, safety incidents, and lost production hours.

- The percentage of employees covered by health and safety insurance

Policies prohibiting child and forced labor.

Policies to suppliers and vendors to ensure ethical sourcing

- Document CSR activities, including total time and financial resources allocated.

- The number of training sessions held (e.g., skill upgradation, soft skills, health and safety)

- The number of employees trained and the gender breakdown

Complaints related to working conditions and their resolution.

The frequency of injury events and safety incidents.

- The existence of a corporate human rights policy.

- These policies to suppliers and vendors to promote ethical practices across the value chain.

- The adoption of responsible marketing communication policies with a focus on gender sensitivity.

Potenial Industries

Banking and finance

Energy

Healthcare

Manufacturing non-durable

Media and Entertainment

Pharmaceuticals

Public Administration Office

Retail

Technology

Telecommunication

Construction

Education

Manufacturing durable

Oil and Gas

Renewable Energy

Textile

Transportation and Logistics

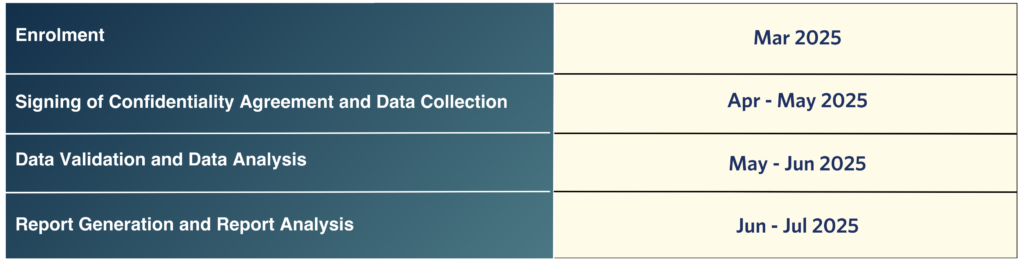

Fee Structure & Timelines

- Fee for the Core 14 Metrics: Rs 250,000

- Fee for up to 50 Metrics: Rs 500,000

- Fee for all 90 Metrics: Rs 700,000

Takeaways

- Training on SECP 14 “S” ESG Metrics

- HCCI Report on industry benchmarks

- Guidance on annual goal setting

- Guidance on how to write ESG report

Disclaimer

The program is an independent initiative by HR Metrics and is not affiliated with any regulatory body. It serves as a facilitation tool to help companies implement voluntary S-ESG (Social-Environmental-Governance) Metrics. However, the program is not limited to regulatory compliance; it also includes advanced competitive metrics that go beyond basic compliance, providing companies with deeper insights and strategic advantages.